SAVING FOR RETIREMENT AND

PLANNING THE FUTURE WHILE

PAYING INFLATED BILLS TODAY ?

WE CAN HELP YOU FIND BALANCE

AND BRIDGE THE CASH FLOW GAP.

WE REMAKE RRSPS & RRIFS INTO

PORTABLE PERSONAL PENSIONS.

PLAY VIDEO TO FIND OUT MORE.

5 key advantages of PensionizeMe model

do not curb your budgets,

expenses and expectations.

find out why we can offer

1.LowER management costS

2. SUPERIOR BUSINESS MODEL

3. OPTIMISED TAX STRUCTURE

4. RELIABLE DIVIDEND INCOME

5. CONTROL & TRANSPARENCY

WHAT CLIENTS SAY

I connected with Ray to discuss a strategy for my retirement and I couldn’t feel more confident and pleased in the plan he created for me as well as his service. He was extremely professional, strategic and honest. I’m thrilled to have found such a knowledgeable and trustworthy Portfolio Manager to help me reach my investment and retirement goals. He provided sound guidance and highlighted financial strategies that I haven't received from any other wealth management advisor. I would highly recommend Ray to anyone looking to strengthen their investment and retirement goals further.

Aida Juodis

I have been working with Ray for about five years now managing my investment portfolios. There are a few things that stand out with Ray and the service I receive.

First, being independent Ray is not restricted to any specific proprietary product. He can access a variety of investments that are helping meet my family’s goals and objectives. Second, he is focused on generating income with an eye on capital preservation and tax efficiency, which so far has been successful. Ray not only uses Closed End Funds (CEFs) to generate reliable income at discounted prices, he also introduced me to covered call strategies that make sense. Finally, his approach to management fees leaves more money in my accounts to grow over the long term.

I enjoy working with Ray and discussing “where the puck is going” and adjusting as market conditions change. His level of client service is impressive. Ray is not the type of advisor to hide behind voicemail and he returns messages in a timely manner which is refreshing.

D. Ghose, Head of Research, Canaccord Genuity (ret.)

Ray and his team have been incredibly supportive through the process of learning about how different investments work, and getting started into finding a way to successfully invest in our future. I would recommend anyone considering learning more about investments all the way to seasoned professionals to work with this amazing and knowledgeable team.

Christina King

conventional

compensation

Traditional Investment Counselling firms charge varying fees as a percentage of assets.

Commissions may also be charged in addition to the management fee.

The following is a sample of what a sliding fee schedule will look like and could be subject to a minimum charge.

first $500K @ 1.50% = $7,500

next $250K @ 1.25% = $3,125

next $250K @ 1.00% = $2,500

$1M+ @0.50% = $5,000

$1M managed = $13,125

Fees in these circumstances should also be tax deductible for non-registered accounts.

flat fees for

sharp people

PensionizeMe prides itself on

simplicity and fee transparency.

Our fees are 1.00% of Assets

managed, with a minimum fee of

$3,500 plus HST and a hard ceiling

set at $7,500 Flat.

Cost of trades is 15.00 plus HST.

PMWS does not make money on

Trade commissions we charge.

$250K = $3,500 or 1.4%

$400K = $4,000 or 1.0%

$500K = $5,000 or 1.0%

$750K = $7,500 or 1.0%

fund trailers

and expenses

Mutual funds are a great vehicle to get you started on the road to saving for your future. Mutual fund fees vary greatly between the type (equity vs bond) and “class” of fund.

Morningstar’s new study found that Canadians pay some of the highest fund fees globally.

The median for allocation funds came in at 1.94% and 1.98% for equity funds.$250,000 @ 1.94% = $4,850

$400,000 @ 1.94% = $7,760

$500,000 @ 1.94% = $9,700

$1 MIL @ 1.94% = $19,400

Fees charged by mutual fund companies are not tax deductible for any type of account.

why are wE WILLING AND Able to charge less.

SNAP SHOT

Portfolio Review

Note

If you decide to engage PMWS to manage your affairs, the $600 will be applied to your first-year fees based on the compensation formula you choose.

Flat Fee

Portfolio Review Plus

Ongoing Portfolio Management

- Personalized portfolio construction.

- Written Portfolio Strategy.

- Ongoing Access to Portfolio Manager. Managing the account.

- Quarterly Review.

- Risk Management Review.

- Decumulation strategies to minimize tax & maximize income.

- Sustainable Snowbird Income Strategy.

- Access to Wealth modules to illustrate and educate based on your needs.

- Annual review

- Personal Registered/Cash accounts.

- Corporate Accounts.

- Holdco Accounts.

- Family Trusts.

performance

0.5% + 20% over 5% p.a.

Ongoing Portfolio Management

- Personalized portfolio construction.

- Written Portfolio Strategy.

- Ongoing Access to Portfolio Manager. Managing the account.

- Quarterly Review.

- Risk Management Review.

- Decumulation strategies to minimize tax & maximize income.

- Sustainable Snowbird Income Strategy.

- Access to Wealth modules to illustrate and educate based on your needs.

- Annual review

- Personal Registered/Cash accounts.

- Corporate Accounts.

- Holdco Accounts.

- Family Trusts.

ARE YOU RETIREMENT READY?

OR NOT? WATCH TO FIND OUT.

MethodS

1. Identify Unforced Errors

2. Bring Predictable L.U.C.K.

3. Knowing Your Strategy Pays

4. Precise Tools and Execution.

5. Rules based Income Investing

About You

You may be planning for retirement, or you may already be there.

The sooner you decide to get ready for what’s coming and optimize your asset allocation and tax structure, the better.

Regardless of your age, you should know if your money will last for your life expectancy.

Are you Retirement Ready or not? Find out.

About Me

PensionizeMe Wealth Services (PMWS) conducts its advisory business on the independent integrated platform of Aligned Capital Partners Inc (ACPI).

Ray Dragunas is a Senior Portfolio Manager and veteran of the Investment industry with over 25 years of experience servicing the wealth management needs of some of Canada’s wealthiest families.

WHEN AGE IS NOT

"JUST a NUMBER".

Retirement may be something you planning for. Or you may already be there. In both cases, you need to know if your money will last for your life expectancy. In other words, are you Ready?

Or Not ?

Being RRON means you can answer the following questions easily:

- What rate of return you need on your investments?

- How much do you need to save?

- At what age can I retire comfortably?

- Will I have to reduce my retirement lifestyle?

PensionizeMe Wealth Services answers questions, then puts a strategy in place to get as close as possible to your goals, while minimizing taxes & cutting cost.

HOW TO APPLY

our methods

- Identify the Wealth Transfers.

- Take control of all your Assets.

- Personal Economic Strategy.

- Have trade execution set up.

- Monitor and adapt on the go.

Species that Survives, nor the

Most Intelligent, but the One

Most responsive to Change.

– Charles Darwin.

pensionizeme

top ten model

PensionizeMe Wealth Services (PMWS) seeks to minimize costs when managing client portfolios. Keeping an eye on cost, like in any business, means more money working for you and your future.

A few people have asked how can your fees be so competitive? The answer is simple. PMWS leverages technology and as result we can pass along the savings to our clients. PMWS uses leading edge professional screening tools that minimize the time required to find opportunity and then decide whether to act.

PMWS helps meet client needs using Closed End Funds (CEFs) Top 10 Yield & Discount Strategy and top Exchange Traded Funds (ETFs) to attempt to develop a sustainable tax efficient income stream. In essence, a Pension Plan.

How do you do it?

How can your fees be so competitive? The answer is simple. PMWS leverages technology and as result we can pass along the savings to our clients.

PMWS leverages technology throughout the client experience. From client onboarding, reporting, managing accounts to using screening tools in our investment process.

ELEMENTARY

Methodology.

five SIMPLE STEPS TO automating INCOMEs

and leveraging technological advances.

1. COSTs.

There are 5 areas where wealth transfers occur:

- How you finance your home purchase.

- Taxes. Don’t pay more than you should.

- Using Retirement plans effectively.

- Savings for Education.

- Paying for Major Capital Purchases

There are saving that can easily be identified in each of the 5 areas. Those saving can then be put to work for the future.

2. L.U.C.K.

To stress how important it is to be able to access your money, PMWS like to use the acronym LUCK.

Liquidity – knowing you can access your money easily.

Use – Accessing your money is for your use and not subject to outside opinion.

Compounding – Having your money compound for your future use in a tax efficient manner.

Knowledge – knowing that your money is working for you and your future and no one else’s.

3. strategy.

After identifying your unique issues and goals, present a strategy that focuses on generating tax efficient income with an eye on risk management.

Earning income and growing your capital is one thing, keeping the most you can after tax is key.

Most people play to win. Some people know that the easiest way to victory is identifying unforced costly errors.

Eliminate these and win by refusing to lose.

4. ExecutiON.

After we present the strategy, it will be put into action across your household accounts, scaled in over an agreed upon time frame. Any areas where wealth transfers are occurring will also be addressed at this stage and a strategy put in place to save those dollars and get them working for you.

Our strategy requires precision and a mini trade desk to work. In Allinde CMP we have a digital tool box, a Swiss army knife for fast, efficient execution of index rebalancing trades.

Please visit our trusted and verified Partners websites.

Find out more.

5. MONITORING.

Unfortunately, many changes to portfolios tend to be made on an emotional level. This is understandable, after all you worked hard to save and invest, and you don’t want to lose.

PWMS removes the emotion by using a rules-based approach to invest for parts of our portfolios. We work hard to choose investments that even if they drop in value temporarily, should continue to comfortably pay out an income stream to our clients.

Market conditions can change almost daily. PMWS are not day traders. We are sensitive to changes in market sentiment. If we feel that there is a need to make changes to the portfolio we will.

TRUSTED PARTNERS.

Please note : Partner services are sold by independent entities or individuals, separate & distinct from PMWS.

videos, guides

& case studies

Volatility and the other side of ETFs

During these unprecedented times, industry experts turn to investment vehicle for another indicator...

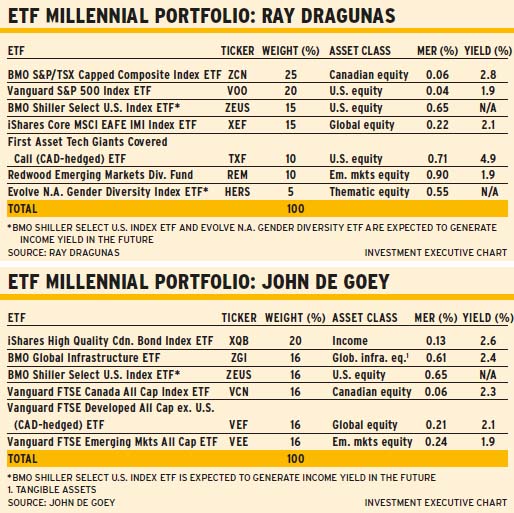

ETFs: The value of starting early

Millennial clients who begin a low-cost plan of saving for retirement now will reap the benefits over time. ...

Calculating the CEF discount

When it comes to CEFs investor sentiment and the limited number of shares available play a role in determining discounts and premiums to NAV....

Open your Portfolio to CEFs

In the last issue I addressed the potential discount mechanism that exists in Closed End Funds (CEF)...

Why us?

WHY AN INTEGRATED ADVISORY BUSINESS MODEL IS A WIN-WIN FOR RETIREMENT PRACTITIONERS

Why people change advisors and why would you short list us as a possible choice? What are the advantages of working with us? Here are five reasons to consider:

1. Big Picture perspective

This involves looking at all aspects of your financial situation, including your goals, risk tolerance and overall financial health, in order to create a comprehensive wealth management plan.

2. Fee-Based

Being fee-based means our economic interests are aligned with yours. If you are successful, we are successful. It also means you aren’t tied up for years in complicated products. We are humans, so we have made some mistakes before, but we learned from them, we got better and moved on. We also believe this is the best client-advisor relationship model.

3. I am an Advisor, Not a Salesman

I focus on understanding and meeting your unique needs and goals, and providing personalized recommendations and strategies that are tailored to your individual financial situation.

Let me be radically honest. I am independent advisor, experienced, straightforward and I work for you.

4. Honest and Direct Advice

I pride myself on giving advice that is not only honest, but its also direct. Sometimes, that means giving you recommendations and advice you need to hear. I believe that plain-spoken, direct advice will better help you reach your goals.

5. Evidence Based, Education Driven

Deciding who to work with can be a complicated process.

How do you know who is verifiably trustworthy? We offer free education on important topics. You “can kick our tires.”

However, the best way to know is to join us.

We are confident our initial conversations and complete transparency eliminate any surprises.

In the end, you don’t know what you don’t know.